First Heritage offers Traditional and Roth Individual Retirement Accounts.

An Individual Retirement Arrangement (IRA), commonly called an Individual Retirement Account, is a personal retirement savings plan available to anyone who receives taxable compensation during the year. For IRA contribution purposes, compensation includes wages, salaries, fees, tips, bonuses, commissions, taxable alimony and separate maintenance payments. You can open an IRA Savings account or IRA Certificate

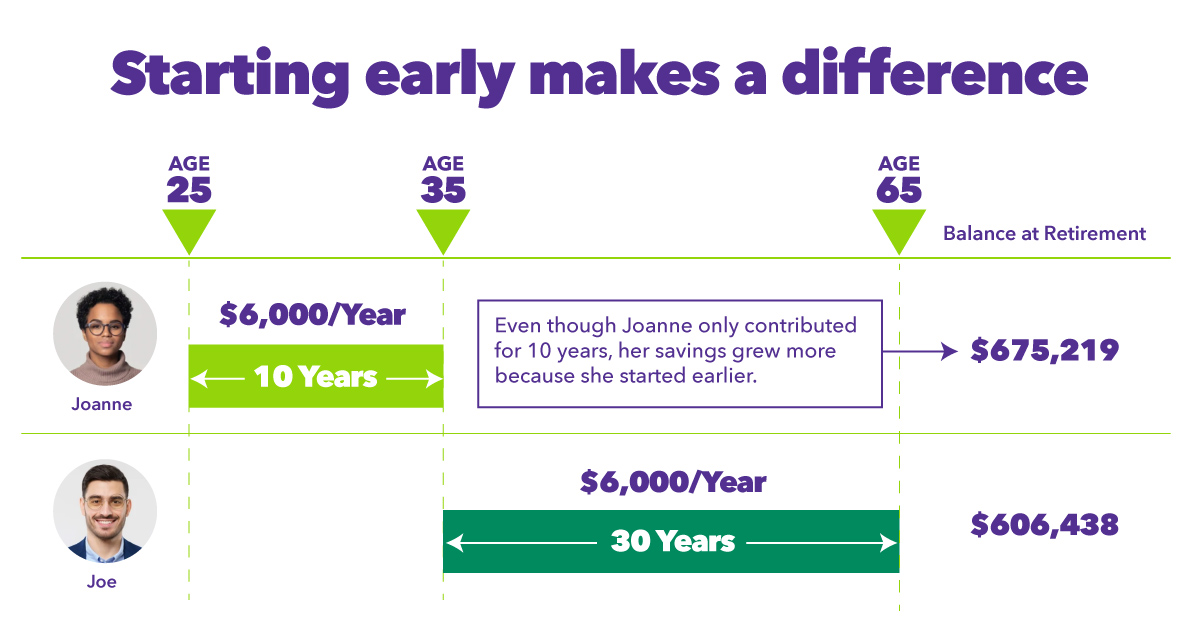

There is no minimum or required IRA contribution to start your IRA. All it takes is a few minutes to start planning for your future!

Here is a general overview of the main differences between Traditional and Roth IRAs. Use it to help you decide which IRA is right for you. You will also want to talk with your tax advisor.