General

What is a credit union?

A credit union is a not for profit money cooperative whose members can borrow from pooled deposits at low interest rates. Members are the owners.

What is the difference between a credit union and a bank?

Credit Union depositors are members and each member is an owner of the credit union. Banks’ depositors are customers and have no ownership interest. Banks are owned by investors.

Since credit union members are owners, each member, regardless of how much money they have on deposit, has one vote in electing a board of directors and members can run for election to the board. Banks are owned and controlled by stockholders. Customers don’t have voting rights, cannot be elected to the board and have no say in how the bank is operated. A credit union’s board of directors is comprised of volunteers and a banks’ board members are paid.

Who can join First Heritage?

Anyone who lives, works, worships or attends school in the eleven county community, comprised of the Allegany, Chemung, Livingston, Schuyler, Steuben, Tioga, and Yates counties of New York, and the Bradford, Lycoming, Potter, and Tioga counties of Pennsylvania, as well as their immediate family members.*

*Immediate family member is defined as spouse, sibling, children, parent, grandparent, or grandchild. For our membership purposes, immediate family member includes stepparent, stepchildren, step-siblings, and adoptive relationships in this definition. Household is defined as persons living in the same residence maintaining a single economic unit. Membership eligibility is extended only to individuals who are members of an immediate family or household of an eligible credit union member. Remember, it is not necessary for the primary eligible member to join the Credit Union in order for the immediate family member to join.

How do I open an account?

Becoming a member is easy. You can stop in any branch, open an account online or schedule an appointment today! All you need is a minimum of $5.00 to open your Savings account.

What types of products does First Heritage offer?

We offer a wide range of products and services to meet your needs. We offer savings accounts, club accounts, checking accounts, certificates, IRA’s, youth accounts, auto loans, personal loans, home equity loans, mortgage loans, digital banking and so much more.

What is your routing and transit number?

222 381 882

Are my accounts insured?

Yes, your funds are insured up to $250,000 by the National Credit Union Share Insurance Fund. There are many ways to increase your amount of coverage. Visit MyCreditUnion.gov for more information.

Do you offer notary services?

Yes, we offer Notary Services for our members at almost every location and it is free of charge. Schedule an appointment today!

What are your Saturday hours?

For a current listing of our hours and locations visit our Locations page.

Do you have a coin machine?

We currently offer coin machines at our Corning, Elmira Heights and Mansfield branch locations at no charge for members.

How do I wire money?

View our wire instructions or stop by any office to obtain a wire transfer request form.

Where are your ATMs or night drops?

Do you offer Medallion Signature Guarantee services?

Yes, if you are in need of a Medallion Stamp Guarantee, Schedule an Appointment today.

How can I order checks?

Members can order checks through digital banking, calling 800.833.3338 and stopping into a branch. Costs of checks vary depending on the design you selected. Members 55 and older also receive one free book of checks a year. Click here to re-order checks.

Do you offer Money Orders?

Money Orders are available at every branch location. There is a $3 fee when getting a money order and the limit is between $1.00 and $1500.00.

Do you offer Savings Bonds?

We do not offer savings bonds, but we are able to process them. To purchase a savings bond, please visit the Treasury Direct.

Can I deposit cash and checks using your ATM?

You can deposit cash through ATMs at all of our branch locations. Check deposits through an ATM are also accepted with the exception of our Elmira Heights branch.

Do you have safety boxes?

No, First Heritage does not offer safety boxes.

What is my member number?

Your member number or account number can be found in account details in digital banking, your membership card or by calling our Member Services Specialists at 800.833.3338.

What is your policy on foreign currency exchange?

At this time, First Heritage does not accept or exchange foreign currency.

How do I make a stop payment?

You can call 800.833.3338 or stop into any branch to do a stop payment. You can also do a stop payment right through digital banking! Login into digital banking and select the account the check is drawn off. At the bottom of the menu select "Stop payments" and follow the on screen instructions.

How do I set up direct deposit?

To set up direct deposit you will need your account number and our routing number: 222 381 882.

Digital Banking

How do I enroll in digital banking?

To enroll in digital banking, click login, enroll now and fill out the information provided.

How do I reset my digital banking password if I have forgotten it?

You will be able to select how you want your password reset link, either via email or the phone number that is on file. After that, you should receive an email or text message with a link to reset your password. If you get locked out of your account or have any trouble, please call us at 800.833.3338.

Can I view multiple accounts with one login?

Yes, we can set-up multiple accounts under one login. You will need to fill out an Alternate Account Access Form which is available by stopping into any branch or by calling us at 800.833.3338

How do I transfer money to another account online?

You can transfer funds to any other First Heritage member online by clicking on “Member to Member” in digital banking. You will need the account number of the person you are transferring to, and the first three characters of their last name.

If you do not know the account number of the person you are transferring funds to you can use our free Bill Pay feature to send funds electronically to anyone at any financial institution. The information required is the email of the person you are transferring funds to.

Additionally, you can transfer funds to other financial institutions by using our external transfer feature. This feature is free and allows you to transfer funds to and from an account you have at another financial institution.

Is digital banking secure?

SSL and Firewalls

Digital banking is accessed through a Secure Socket Layer (or SSL). This means all data transmitted to or from First Heritage’s computer systems are encrypted and use the most sophisticated security available. Several firewalls exist to prevent unauthorized access to the system to ensure your information is accessible only by using a correct Username/ID and Password.

Digital banking is accessed through a Secure Socket Layer (or SSL). This means all data transmitted to or from First Heritage’s computer systems are encrypted and use the most sophisticated security available. Several firewalls exist to prevent unauthorized access to the system to ensure your information is accessible only by using a correct Username/ID and Password.

Username/ID and Password

It is very important that only you know your Username/ID and Password. This is the only way your account may be accessed. Three (3) unsuccessful attempts will lock out a user from accessing their account. If a user becomes locked out, you may use the "Forgot Password" feature to unlock your account and reset your password or call one of our member services specialist for security purposes.

It is very important that only you know your Username/ID and Password. This is the only way your account may be accessed. Three (3) unsuccessful attempts will lock out a user from accessing their account. If a user becomes locked out, you may use the "Forgot Password" feature to unlock your account and reset your password or call one of our member services specialist for security purposes.

Automatic Log Off

After a ten minute period of inactivity, the system will automatically log you off and force you to re-enter your Username/ID and Password.

After a ten minute period of inactivity, the system will automatically log you off and force you to re-enter your Username/ID and Password.

Transaction Monitoring

First Heritage contracts a third party to perform transaction monitoring. Transaction Monitoring is an online risk management system specifically designed to optimize fraud investigation resources by identifying high-risk online activities in real time. Transaction Monitoring detects, analyzes, and scores each online activity and also uses information collected from its Fraud Network (a cross-organization, cross-application, cross-border online fraud network) to identify fraudulent activities.

First Heritage contracts a third party to perform transaction monitoring. Transaction Monitoring is an online risk management system specifically designed to optimize fraud investigation resources by identifying high-risk online activities in real time. Transaction Monitoring detects, analyzes, and scores each online activity and also uses information collected from its Fraud Network (a cross-organization, cross-application, cross-border online fraud network) to identify fraudulent activities.

Multifactor Authentication

For transactions that do not pass the transparent authentication layer, or are deemed “high risk,” by transaction monitoring, users must clear an additional authentication method. First Heritage uses multifactor authentication where the member will receive a one time passcode to a registered device.

For transactions that do not pass the transparent authentication layer, or are deemed “high risk,” by transaction monitoring, users must clear an additional authentication method. First Heritage uses multifactor authentication where the member will receive a one time passcode to a registered device.

How can I change my username?

You can change your username right in digital banking! In the dashboard, click on your name and then settings. On the following screen click on security. Here you can change your username, password and passcode. For assistance call us at 800.833.3338 and a Member Services Specialist would be happy to assist you.

How do I update my address, phone number or email address?

Login to your digital banking and click on settings from the full menu.

What kind of services do you offer online?

- Check your balance

- Transaction history

- Transfer funds

- Free Bill Pay

- eStatements

- Alerts

- Access check images

- Online loan applications

- Remote deposit through our mobile app

- Open a new account... and so much more

How do I download your app on my smartphone?

From your smartphone, navigate to your app store and search for First Heritage Federal Credit Union.

Android Users

Android Users

Loans

Do you offer extended warranties on vehicles?

Our participating indirect dealerships offer extended warranties when purchasing a new vehicle.

What is GAP (Guaranteed Asset Protection)?

GAP is a non-insurance product, used to help fill the gap between what your vehicle insurance will pay and what you owe on your loan if your vehicle is totaled. It can be purchased to cover automobiles, light trucks, motorcycles, boats, travel trailers, etc.

How do I apply for a loan?

You can apply for a loan by calling 800.833.3338, by stopping in any branch, scheduling an appointment or using our convenient digital application center. To check the status of you loan application, contact a member services specialist at 800.833.3338.

How long does it take to find out whether my loan request was approved?

It generally takes one business day or less to find out if your request was approved.

Do you offer business loans?

We offer many types of business loans. Please contact one of our business specialists at 800.833.3338 for more information. Or Schedule an Appointment today!

What is Debt Protection?

Debt Protection plan options will cover all or part of your obligation to repay a loan due to specified events, such as death, disability or involuntary unemployment.

Do you offer hardship loans?

First Heritage does not offer hardship loans, but we do offer consolidation loans. For more information, please call 800.833.3338

Can I skip a loan payment?

Our Skip A Pay program allows you to skip a loan payment for a $25 fee. You can skip a payment in digital banking or call us at 800.833.3338 and a member services specialist would be happy to assist you.

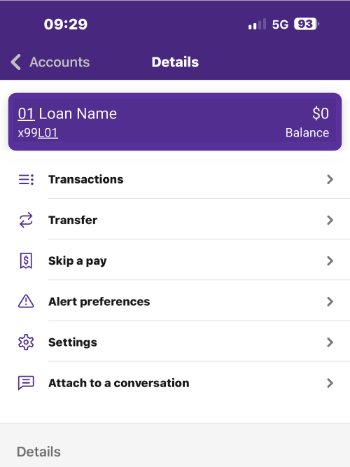

Where can I find my loan/share ID?

Your 2-digit Share ID or Loan ID can generally be found on your monthly statements or in digital banking shown underlined below:

How can I get a loan payoff?

To request a loan payoff, please call us at 800.333.3338.

Cards

What should I do if I lose my Visa® debit/credit card?

You should contact us immediately if your card is lost or stolen. You can report your card lost or stolen 24 hours a day at JHA Hot Card Center™ by calling 1.888.297.3416 (within U.S.) or 206.389.5200 (outside U.S.) and you can block your card using card management in digital banking.

If I am using my Visa check/debit card to make a purchase, should I choose "debit" or "credit"?

You should always select “credit.” The amount of the purchase will be deducted from your checking account and your purchase will be protected under Visa regulations.

How can I set up to pay my Visa from another financial institution?

You can use our transfer feature to transfer funds from another financial institution to your account with First Heritage. Funds will be deposited into your savings or checking account and you can then transfer the funds to your Visa. Or if you prefer, we can have those funds automatically transferred to your Visa once they have been deposited. Contact us at 800.833.3338 to have an automatic transfer established.

Can I set up an automatic transfer or payroll transfer to pay my Visa?

Yes, we can set up an automatic transfer to your Visa in a variety of ways to best suit your needs. Just give us a call at 800.833.3338 and we would be happy to take care of that for you.

What if I am traveling internationally?

Our Visa debit/credit cards are accepted anywhere Visa is accepted. We recommend updating your travel notices in the First Heritage app or contacting us and we would be happy to help. Please note, Visa assesses a small fee of 1% of the transaction amount for international purchases.

What if my card has fraudulent transactions?

If you notice fraudulent transactions please contact us immediately at 800.833.3338. You can also immediately turn your card off using card management in digital banking. Or Schedule an Appointment today!

What are your ATM withdrawal limits?

First Heritage debit card holders can withdraw up to $510 in a 24-hour period.